Once again, I want to welcome you to today’s video. We started yesterday looking for tips to overcome FOMO. And of course we looked into what is FOMO in trading, we looked into characteristic of FOMO trader. We also look into factors that triggers FOMO. And then of course we were to start FOMO trading versus Discipline trading cycle yesterday. So that’s where we will continue today.

So yesterday, as I said, we’ve looked into what is FOMO in trading. If you miss that video, you can check it here. Make sure you watch that before you continue with this so that you will be able to get the full gist. Full gist okay. We’re talked about what is fomo trading. Then we looked into the emotions that governs and controls FOMO. And ofcourse we looked into a FOMO trader experience. That was discussed in yesterday video, and we look into seven things most FOMO traders did.And ofcourse we looked into the factors that triggers FOMO trading.

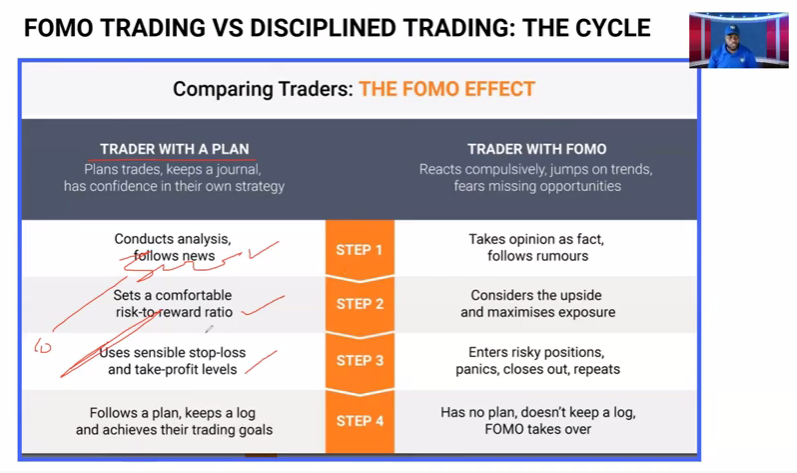

So let’s talk about fomo trading versus discipline trading – the cycle. When we competitor, okay. Comparing a trader with plan. Okay. As a forex trader you need to have a plan.

It turned out trader with fomo did not have a plan. Okay So when you have a plan, you plan your trade. You keep the journal, you have confidence in that strategy that you have. You are using tradermatic, you believe in signa, you don’t blend strategy. You are following two, three, four, five people online. You get this strategy from this person, you get this from this, you merge it together.

It becomes a strategy that has not been tested.And that is why most people lose their money. So if you are a trader with a plan, you conducted your analysis before the news, you don’t just jump into it. You set a comfortable risk to reward ratio. Okay You don’t just gamble. You use a sensible stop loss and take profit level.

You don’t, you are not risking $10 and want to make $5million. It doesn’t. That can’t work. You follow plan, keeps it log and achieved your treading goal. So do you have a goal as a trader So that is what you work with. Traders with FOMO.Okay. We are trying to compare them. This ones. They take opinions as fact. They follow rumors. They don’t have a plan. They don’t do analysis.

They don’t know how the signals are being generated. They just enter it and they trade. They consider the upside. I might as well as exposure. Okay Enter risky positions. Panic goes out to repeat, you know, when they are entering positions is very, very risky. It come with a lot of risk. They don’t control their risk. They don’t have stop loss. No specific take-profit and they panic, they close the trade and the cycle repeats itself.

Okay. These people, they have no plans. As I’ve said, it doesn’t keep it locked in. They don’t have a journal. And the FOMO takes over their trade. These people before you know it, what parts of the statistics of those 90% that lose forex account within the first 90 days.The same thing will repeat itself and they will burn out their account.Okay. So you need to avoid this side and be on this side that is how to do it.

Okay. All right. So let’s look into my experience. You know, like yesterday I, I was, I wasn’t feeling too good yesterday, so I woke up to trade london session . and I just have this terrible headache. And then of course I went back to sleep. Then I woke up like a one hour after I look at my phone and I saw a trade on gbpusd I saw the chart was going up, immediately on my phone I just place buy. I didn’t look at my analysis.

I don’t know what has happened before. Remember I wasn’t even in middle of sleep.I used to eyes open and I opened up long position. As I’m talking to you, now that trade is still on minus 600 and something dollars. Even though I know it will eventually go back. Because I am one of those stubborn traders. I don’t close my trade easily. I hit, I don’t do that.

So I don’t know about to you, some also have that same experience. And I would love to hear from you, leave your comment bellow how has this fomo thing affected you. You know, sometimes it might be okay, you set your daily goal and after and after you’ve reached your daily goal, and you still see a possibility that you supposed to just walk away from. You place this trade and before you know it, it goes against you.

Okay So now let’s talk about tips to overcome FOMO. Here are the tips and reminder me the tips and reminders to help manage the fear factor and the fomo factor.

Number one, know that that will always be another trade.Okay. There will always be another trade. Trading opportunity are like buses. If you take bus another one will come. Even if you miss this one, another bus will come. Okay, everyone is in the same position. It doesn’t matter if you see a trading opportunity. The money, the capital account size might be different but every body is on that same position.

Stick to your trading plan. Okay Stick to your trading plan. And as I’ve said, stop blending strategies, thinking the emotion out of your trading is one of the factor that will help you to put emotion aside. Okay. traders should only use money they can afford to lose I’ve said this over and over and over. It’s common sense 101. Do not risk money you cannot afford to lose.

Okay. Knowing the market is essential. If you have been following me for a while also you will know I’m very big on this. You are not trading trade GBPUSD, you trade EURUSD, you trade japannese, you trade indices, you will be confused. You will not know that market. Stick with one with one currency pairs. Know how that currency pairs behave and you will discover you will make more money by doing that. Okay.

So FOMO isn’t easily forgotten or it can be controlled. I’m creating this video, it still affect me.But of course, creating this video for you am also creating you am also creating it for me. So it helps me to remind myself what I have said over and over and over. So keeping a trading journal help with planning. If you are trading on one minute, their is no way you can keep a trading journal. If you are trading on a higher timeframe, you have time for analysis and of course you can keep your trading journal.

I give a trading journal to all my student and it take you to keep your journal very well. FOMO just didn’t happen overnight, or you need to know it’s an ongoing process. You begin to walk on it. Okay So my friend what we have covered in this past two days; is what is FOMO in forex trading,we talked about the characteristic of FOMO trader, factors that can trigger FOMO, we look into FOMO trading versus discipline trader,and of course the cycle. And I shared one of my experiences. And finally we looked at tips to overcome FOMO. I hope this made sense to you. And if you’ve value in this content. Come on, show us some love, okay Subscribe to this channel. If you have not like us on facebook, like this video, share it on your Facebook profile on your page. Share this video with someone. It could be a blessing to somebody. I love you. Thank you so much. And I will see you tomorrow.