In this video, we are going to be looking into crypto currencies crash that just happen, how they are manipulating the market, what you need to do to guide them, you know, protect your assets and your investment. You know, I saw, I stumbled this video and I think I love the content. I’m going to drop the link below this video, a YouTube channel. Make sure you subscribe to this channel,

We are not going to talk about everything that happened and I’ve touched on this stuff before, but at this time it happened in earnest. So let’s tweak a couple of things and jump right in. Let me see if you guys can hear me. Okay. So I’m going to talk about everything. Move Bitcoin and crypto use to try and calm everybody down. This was quite an incredible evening and talking about everything, why it happened, who was doing it, how they’re doing it and what to look for as well as we will go forward. So again, you know what this challenge is about and none of this of course is investment advice. So no more wasting time on that. And I said, yesterday, key common huddle. Didn’t expect us to drop $10,000 in a matter of hours. So, but then it bounced right back.

So first of all, I need a value. I think we all need it. Actually. I thought about having a Heineken beer or a glass of wine that during this live stream to do it like a meet George, anyway, gentlemen, here we go. So typically, and my modus operandi for my whole life has been when fear is at its maximum, where people are leaving the building I’m running in on the building’s on fire, I’m running in and this is the old fear of green to index because you know, you’re almost of extreme fear. We are extreme fear, but it’s been lower than that in the past, but it’s pretty much as low as it can go. So watch for that. Anybody at maximum fear is a good time. Maximum enthusiasm and confidence is typically at that time. But let’s talk about why I think everything is happening.

First of all, to build stories, take it back into it takes a lack of time. So for the first time, the swell guy like you and me, we can front run wall street, however freedom comes at a price. So I was trying to think of the best way to articulate exactly what’s going on here. So the good thing about Bitcoin is it’s free from any protections, which also is a bad thing. And that means a can be manipulated and is being manipulated on a weekly daily basis. And since the beginning of time, and that brings about a lot of fear and it brings a lot of, a lot of capitulation and that’s what we saw today. People broke. They had the people that time vis they timed it perfectly. They executed perfectly, you know, in terms of the FID and everything else. And yes, I do intermittent fasting.

I eat a shake, a vegetable blend at lunchtime and would grilled vegetables around 6:00 PM. I eat twice a day. So maybe thank you for that question, but what happened And I’m going to go in detail to this whole orchestration. Bitcoin fell 53% or five weeks. I went up 35% to three and a half hours. So look at all those fives and threes that we always like to see patterns of numbers. That’s just uncanny. And the question is not, is this a new bull market as bullish as ever not prove the case as well as to why So no need to panic and be funny, but what’s really going on. Why is this all happening So I think because the small guy like you and me as from wall street and people know that Bitcoin is the most pristine asset of our lifetimes and perhaps in the history of the world, the retail investor has the bags. The small guy has the bags and now all of a sudden the money, us wanting the millionaires, want him, the billionaires, wanting everybody wants it and they don’t have any bags. So how are they going to get the coin away from you all And that’s exactly what they’ve been planning.

Funny. First of all, it’s, Bitcoin’s going to $4,000. And then in January, February is like, oh, we don’t have enough Bitcoin that scare the heck out of the market. What can we do It’s going to 20,000. It’s going to be 25,000. Everybody get nervous. It’s going to crash. And then, and he probably works behind the scenes with a whole bunch of other people to make stuff happen. And that is what I believe is going on. Maybe it’s a conspiracy theory, but I prove it’s probably not. So first of all, you look like the more rich clients are getting serviced today that was ago. Wells Fargo announced they’re going to offer capability for crypto, invest over $50 million or a hundred or whatever the case may be. JP Morgan, same thing, Goldman Sachs, same thing. Now Wells Fargo. So do you guys all see a pattern The pattern is they are all lining up to generate funds to give Bitcoin to the highest and wealthiest individuals out there, but they need to be able to sell them in the first place.

And they don’t want to spend 60 bucks, a thousand dollars or 77,000 or a hundred thousand, therefore, a lead to shake the trees, shake the weekends and grab the coins away. So we’ll prove points. JP Morgan, master manipulators. We all know, the stuff that they have done in the past for 2030 years, they’ve been manipulating the gold price. So here today, again, a few hours ago, they said institutional investors, dumping big crews in favor of gold, give me a break that is just garbage. And they manipulate the gold market. So who do you trust It’s like, Ooh, would be really painful. Gary, yes, I haven’t looked into next. I’d be very careful. There are some people that wrote to me regarding being scammed from Mexico. So be very careful. Think about Celsius. So thanks for that question. Sorry for disturbing this. Because some people ask questions that I need to protect them.

So I do a very quick introduction. So based on open insure, open interest in see me Bitcoin futures, these contracts, they believe the price is going down and this is all well, if you look to my video yesterday, I proved that the actual contracts are three to one on the bullish side for Bitcoin. That was before any of this happened. So longterm, medium term, everything’s still remains very bullish. Now max Kaiser case, he gave his point of view. We’re going to JP Morgan. These guys have just finished paying a billion dollars in the fine for manipulating gold prices. And now they’re connected Bitcoin to gold. Come on. It doesn’t make any sense. They lowered the price target as well for Bitcoin, which isn’t too bad. They said price targets and from 146,000 down to 130,000. So that’s not too drastic, but max Kaizen was very funny.

Say nice, tried crooks, trying to shake people free. But the sad thing is people are losing money. And I’ll talk about more of those methods later. But first of all, let’s talk about big firm manipulating what’s going on right now, some soundbites, this was on Reddit and it’s been widely publicized. And this was work story. The FID campaign, I E China, Bitcoin bathrooms are stuff we’ve been hearing for years and years. Maybe I’m taught both piggyback and on top of the Elon Musk stuff, and there was a quarterly dump plan for 7:00 AM UTC. And that done I’ll show me exactly how they do that in a few slides, but once liquidated by, or you can, and the projection of $70,000 Bitcoin, next, very clear. You know, it’s an anonymous writer says he works for big firm, probably Chinese based, but this is what’s going on.

And this is what we have to be aware of. And this is a reality today. This is maybe happening again. I am 90% sure. This is the truth. I’m 90% sure everything’s being manipulated maybe 99%, but let’s go a little bit deeper. So everybody was talking about the kickoff orchestrated pump and dump. And I was a bit of a skeptic in the beginning, but over the last week or so, and definitely today, when you look at the pattern chart and what a typical white cough orchestrated pump and dump is, it makes all the sense in the world. Now, this guy came up with these theories over 120 years ago. So I just want to read some of his key quotes. When you take a wholly impartial viewpoint, I’m biased by news gossip, opinions and your own prejudices. You realize that the stock market is like any other merchandising business.

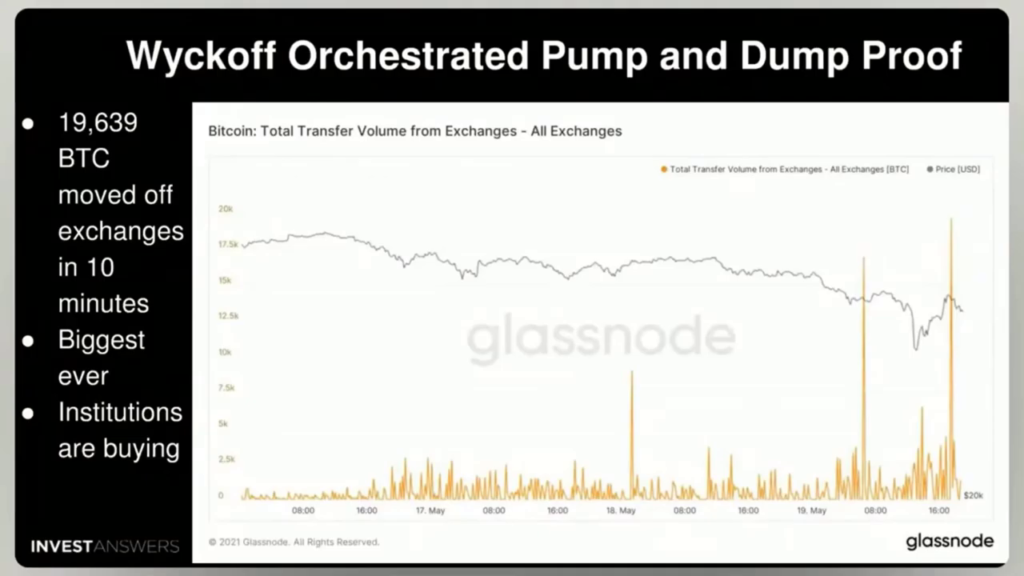

Remember the keyword here is merchandising business it’s to sell stuff, whatever it is, buy low, sell high. Now manipulators even more important can only play in markets that they can move best so they can scare the highest possible rate of turnover of high, real simple like merchandising. This is what he’s talking about now, going a little bit further to illustrate that this pump and dump it was real. The proof within 10 minutes, 20,000 Bitcoins are moved off the exchanges after the crash, after the dump, this has never happened in the history of the world. This proofs, the big institutions like jumping in, they are buying and they’re moving to cold storage instantaneously. Okay So they managed to pull 20,000 Bitcoin or a hell of a lot more amount of time and do they do this So this is something that, how are these things orchestrated

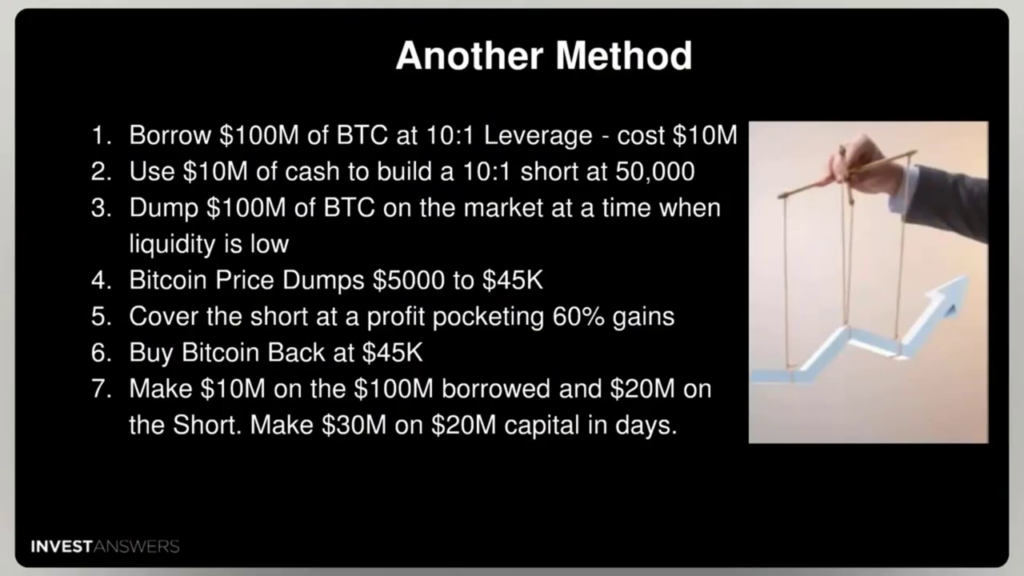

Well, I’ll give you a simple example of what I would do if I had a hundred million dollars to spare and I could take that type of hit. Can we need to do that with severe members to get a big impact So when you borrow a hundred, that was a Bitcoin at 10 to one leverage, you can do 101 bridge if you wanted. So to me, 10 to one that would cost you $10 million. You use 10 million of cash to build 10 to one short position at the same time at say a strike of $50,000 Bitcoin. And in B2B, the a hundred million dollars a Bitcoin, you have you dump it on the market, but you wait for the right time. He waited for the maximum spread to be in play. You wait for people to be nervous and you wait for liquidity low. And that dumping 2:00 AM in the morning.

You don’t know when it’s going to happen. Okay So they’d dump it. They dump a hundred million and the Bitcoin price dump say 5,000 or 10,000 like yesterday. And they cover the short profiting as 60% in gains. And they buy the Bitcoin back cheaper than they bought it. So if I let a little maximum, but they borrowed, this happens over a period of a few hours or a few days, you can make 20 to $30 million on a 10 minute round investment very, very quickly. So this may sound like double Dutch to some of you, but it’s actually really simple. And it’s the manipulation that’s been happening for decades and decades and decades in other markets we’re talking copper, palladium gold cotton futures. It’s it’s, it’s the easiest playbook in the world, real simple. So anyway, that’s how they do it. Now. There’s other tricks that they pull as well, that I want you all to be familiar with.

So there are things called hidden orders where they do things off so people can see they’re also spoof orders. These are fake orders, you’ll say, okay, 10,000 Bitcoin, but they’re not really going to buy it, but they drive the hype. That’s where they can drive things up or down with the say, I’m going to sell 10,000 Bitcoins. Then there’s wash trading. That means they use multiple exchanges to orchestrate big kind of attacks to drive this cascading of selling very quickly. And then they force a liquidation that leads to cascading and selling now. But I want to tell you all as well, these guys that do this, these companies are, what are they are They know where the long positions are, where the strikes are, where the levered, investors are that invest in Bitcoin. And they go long on margin, like 10 to one or a hundred to 105.

It and they wait and they structure it, their positions to wipe these people out very quickly. And with absolute search group position, it is orchestrated it’s completely manipulated and everybody knows. And then what happens next It’s real simple. The whales feast. So the sell-off flushes out the traders that are using excessive leverage. That’s why I don’t use leverage on crypto because I know a dangerous it is. I do use leverage on equities because it’s safer and well positioned traders and larger entities are dry powder. And if you’ve been in the channel for a while, you know, I would say, keep some dry powder. They buy the dip pumping. They know where the bottom is. They knew the green down to 30,000 and they have all the priorities ready at $30,100. So we jumped in and they vital when they dump all their Bitcoin that they bought it off the market for the cold storage in the span of 10 minutes. Okay. And this is just Bitcoin.

Everything will go across the board. So everybody, this is, this is a wholesale manipulation, but there’s some good news and that’s coming. But before I give you the good news, I’m going to say, do you want to give your coins to this guy Cause he looked like he needs more Bitcoin. So let me explain one more time, how it all happens. So the market gets beat to hell and this more beatings is more FID. Men is more FID and then the bargain buyers by panic, then the panic sellers sell at the lowest price. Then everybody capitulates. Then the big money pals in and this guy is going to say, there’s a lot of people that got hurt out there. And a lot of messages from people that the tree lost a million dollars, one and a half million dollars, $2 million, $600,000, $50,000. But for many people, this was life-changing. And this makes me, except among the silence as people that are probably going to end up getting divorced because of this is massive, but you gotta, you gotta be really realize that this happens all the time, so just belong. You know

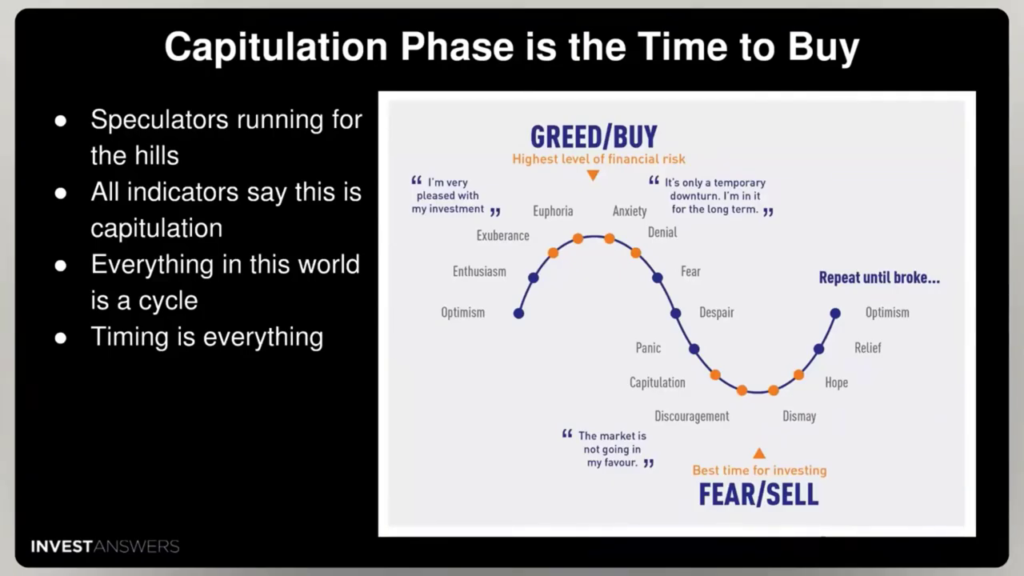

So I just want to say as well, after that moment of silence, that violence alone traders lost for 10 minutes, just one exchange that’s Christmas. So the good news cheer us all up very important. So let’s talk about the capitulation phase. This is a little behind this. Now, if you look at this, the speculators, sadly, either got crushed in the running for the Hills, but at the capitulation phase, which we’ve just gone through, you were a little bit discouraged, but those who are strong, no to move in and buy it and take opportunity of this. So that’s what’s happening. And timing is everything, everything in the market. So that’s time to buy is when this maximum fear, one of the week, people are selling average, which is approximately $40,000. And we are very close to that. Right now we’re about 39,200. So we need to get above that 40,000 to 200 day, moving out to the level that it will be the new support.

We crashed a little bit because it was manipulated. Once we get above that and people can rest easy. That’s the first piece of good news where there look at where we are. Look at the past this blue, market’s not over I’m 99% sure of that. What was that could be, but I don’t think so. The macro backdrop is far powerful. So just like we’re maybe maybe half, two thirds of the way through this bull cycle, but the good stuff has yet to come. Just look at the supply and exchanges. There’s nothing there. The other thing is everybody has to be a believer in the stock to flow model. Okay. This is BS work of art. It is perfect. Look at how aligned it is. Never in the history of the world. That’s been this accurate, this close to the line. Then now even with the blip we just had.

Yeah, there’s a little bro, little yellow moon off of the black line, but compared to previous cycles, it’s extremely on track. So that’s more good news. And that’s good to my favorite. Cathy would, Bloomberg this morning, four or five hours ago, she said, bill still bullish Queensland $500,000 in three or four years. And that’s her charge. Now She said, these are so searching times. She too has been hurt by the capitulation, by the weak market. Her, our ETFs have been destroyed. Everything is out of 20, 30, 40%, but she’s in these disruptive names that get hit hard. First, remember the higher, the beta of the stock, the higher the risk, but also the higher, the return. And that’s, what’s key. Now the environmental concern, she said caused Musk’s to pull away from Bitcoin and she understands us, but she also understands that this is an opportunity and this will drive more renewables from mining and it make it the most pristine asset in the world.

Even more pristine, even more green. So there’ll be no possibility of FID in the future. Now she having a conference in July, in San Francisco with square to talk about this and Bitcoin mining, she’s looking at finding a way to tie this into the very good opportunity. Capitulation always get opportunity, but remember just to be always very cautious and safe, we’re not out of the woods just yet. I get above that 200 day, moving average, once we’re comfortable about that, then we can all relax. So the final lesson before I go to Q and a, so this is from week off. This is literally a hundred and 110 years ago. He says successful taping. That’s how they used to read the ticker tape back in the old days to see the price of stocks and stuff is a study of force. It requires the boat. You to judge for each side has a gracious pulling power. And one must have the courage to go with that.

So the question is, what is Bitcoin I think it’s going up, but just don’t let yourselves be fooled by others, open like this content and open this up to some community with you. All right now. So I’m going to pop up in the questions and see what we got. First of all, I hope I was doing okay. I know we got this. Let’s see what’s going on with the team here. And I hope I didn’t miss any key Kiko. I’m going to scroll up real quick and make sure I didn’t miss any Supercats. So from the hidden rage one, this will pass. This is Bitcoin today. Today’s opportunity. Yes. Well said it is a big opportunity. Remember lipid, the guys that are taking crypto off the market, we are look what they’ve been doing for hundreds of years. They’re trying to get ahead of the retail investor and they need to get their hands on Bitcoin.

And Bitcoin is so scarce. It’s not, I’m funny. Last I heard, I think last time I analyzed last note, that was like 2.1 million coins on exchanges. And somebody said yesterday, there’s about 1.3 left 1.3 million coins. And this is more than 51 million millionaires and they don’t have big Queens. So there simply isn’t enough to go left. So yeah. Right. Let’s jump some questions hit me. Yeah. Carl Cortona. I, did some shopping as well last night, smashed the like, it’ll be good. maybe everyone would be thinking Elan and if she wants to have a sale opportunity. Exactly. I know a lot of people, within patriotic, thank you. Triggered patron as well. How relaxed and calm they’ve been really good. So, but maybe who had the vision and the dream of holding one Bitcoin, they achieved over the last 24 hours. So as I always say, be patient, wait, wait, wait, wait.

Somebody asked me two days ago after my salon video, should I buy some or not $52 I said, no, wait. It fluctuates 20% of the day. Give it time. If you have to buy the $42 24 hours later, there was 42, but it’s been extremely strong. So fell a honey pot. Yeah. I’m one month in 25 K down. My plan was always to hold for three to five years in the bride. Right The bear is Bitcoin Ethan Cardona. Okay. To hold through the bear. So I think definitely Bitcoin is good to hold through the bear. Ethereum, I think provided July goes very well, is okay to hold. And Cardona is a functional of what happens with their smart contracts. They have a lot of stuff coming out right now with their new hard fork. And we just have to watch the space. But as a yes, it’s good to have a long-term perspective, but always be ready to tap dance and you’ll make your gains back.

Don’t worry. I think the future is still very, very, very bullish. but I would think about adding small position and a few other names as well. and I’ve been picking up some of those if you’ve been listened to be, when I heard about it, names like Solano, BNB, et cetera, they’re very good to hold. It’s a good one. Then hit them up for some questions or was every just exhausted from the last 24 hours. And is the future of all payments that love me was a XRP is too. Let’s see my ticket, the micro strategy again, like I, Michael Saylor keeps on buying every week. Every time he’s got $10 million, he buys more Bitcoin. We bought the dip a few days ago or two days ago. And I know he’s trying to find money to buy more. It’s the same thing as rebounds the micro strategy.

We rebounded it’s already way undervalued. So I still hold a lot of micro strategy and I’m not selling at all. So this is a question from Nate visuals. I bought some on a 39. Was that smart let me see checking the price, right. I’m wondering when that happened. So yeah, no, this is 39. It’s very good price. Very smart, indeed. Yes. So there’s always a lag sometimes between how certain things react like the lag between Ethereum and Cardona and the lag between Solano, et cetera. I was actually looking at, poke it up myself because poker just took a huge dip. I was actually watching Salaam early this morning and how it didn’t take any hit at all. I think 39 is a very good price. I am into Solano myself. My average cost is about $41 right now. So you have a cheaper than me.

It’s a nice one late night. Good job. And Alex Casio, when you need the ballroom lend does I’m torn on this one. We’ve had this little interruption in the middle, which is normal. remember the big money the money centers are coming, but they’re coming in July. So I expect a lot of money to come in and this money will continue to flow. It’s not going to be everything in July and August is going to continue for a long period of time. And the combined with that, you’ve got this whole revolution in the area of defy, which I’m very, very bullish on. So I think names I can theory could technically I’m not saying it’s going to happen, but there’s a 10 or 15% chance they could go blast, right through any type of bear market. We continue upwards because of the disruptive nature of what they are not capable of.

I would not want to be a traditional bank right now. It’s a very nervous time for them, for sure. So I’m going to go Smith. 99% of people will be able to navigate crypto, obviously the amount of the speed of using crypto in the future. And I disagree with that. So if you look at the amount of people that have something like a PayPal account, they have the ability to buy crypto square cash accounts. The same thing, there are now way more on-ramps than there were back in 2017. So the men in the streets does have access to crypto. They can buy it at a Safeway grocery store from an ATM machine. So it’s everywhere. And you’d be surprised who is actually buying crypto. Like the old story was, I was in line at home Depot a few weeks ago. There was two guys in front of me speaking Spanish, and they were talking about Bitcoin and they wanted to buy it.

So again, everybody’s in ICP. A good that’s the question too late to hop on ICP. I’ve been looking at it. It looks like it started very high and it’s gone even higher. I haven’t done a full detailed analysis of it yet with price predictions. So it could be, my investment philosophy is always to try and buy before the big run and not get in after it’s a learning rotten because the odds are stacked against you. So very good question. It could be too late, but I am looking at ICP. I hope to have the knowledge the system within a week or so stay true for that. Rishi, the double top theory 2013 bull run looks to be in play along with the lengthening cycle theory in this bull run. Any comment does yes. in fact, I made a comment on patron or discord this morning that I was actually given a tremendous amount of confidence in this flowback because it resembled exactly what happened in the two previous programs.

So as you correctly say everything and it’s still happening with probably half or a little more than half through this bull run. And I think the impact of the bull run will be a lot less, especially for Bitcoin because of the supply of Bitcoin is so, so, so few and the demand is about to explode. I always talk about that tsunami of money. People call it the wall of money that’s coming and people that are buying Bitcoin. Now they’re not going to buy it to speculate. They’re buying it for their families and then children and their grandchildren and their estate and everything else. So yeah, that type of money that comes off at those 20,000 points, I’d left the market in 10 minutes and coming back. So I think I don’t want to sound too bullish, but this bull market has a long way to go and it may not debt as bad as previous ones in the past.

So thanks for the question. PG euphoria, Canadian dollar contribution, all contributions here, go to the furry animals and anybody in need or danger as well. So, that’s it. I just want to thank you everybody for being married. Then he find the last questions hit me up, looking at the market right now. Kathy woods brought a truck of Tesla today. This is a buying opportunity and that’s why I always urge people to have some dry powder finances looking really good. Again, we’re not out of the woods, there’s still some more selling to go, but I think my gut would tell me the Bitcoin selling is close to being done. And that’s your rebound first and then the rest of the group. I’ve a, are they lose Yes. I’m doing an analysis of it coming up and I think that is a top-notch operation. So not a problem, but just don’t put all your eggs in that one basket. Maybe. Thank you so much. You are awesome. Everybody’s awesome. Just be safe up there and take care of each other. And remember the future is very bright, so big. Thank you. Great. I’m going to hang up now and get back to work.