Do not move your stop loss. You don’t need to move that Stop/Loss is part of discipline. My name is Emmanuel Adegbola. And I want to welcome you to today video. You know they call me forex apostle. Because I’m a minister of the gospel and I trade the forex market for a living. In this video ‘m going to be taking you through some of the short videos I created this morning. Monitoring a certain trade.

If you are Forex trader and you are possibly maybe trading GBP USD today, you will know what I’m talking about. How the game, the big boys are been playing. And of course, one of the things that most traders will do is either close their trades, freak out, close the trade, or move their stop loss and when you do that, it means that you do not trust yourself. It makes you second guess yourself. It makes you doubt your your system.

It means you don’t trust the dust system in the first place. So, if you trust the system you are using, if you trust yourself, if you believe in your analysis, you will live everything the way it is, even when the market comes against you. Okay You live it. Remember before you placed out trade, you have identified how much you are willing to lose. Remember in Forex, you can only control how much you are willing to lose. You can control what you are able to gain in any particular trade.

So you put your stop loss is called the risk and the money management. You place the right trade you know, lot size. You don’t over leverage you don’t position that trade. So for example, this morning during the London session, I open trade, I open trade together with some of my students, and of course, some of them trade GBP USD, I traded GDP USD, I don’t normally trade that currency pairs but just for educational purpose I’m trading it. It is still on as I am talking to you right now the markets of course went against us. which I’m going to show you in a minute. Okay Let me just share my screen. This is the trade. Okay. It’s a system that I called the forex apostle sniper system. Okay. Different people might call it different names. So when we entered this trade, of course, this particular place and you could see the market comes down on the, on GBP five minutes of us went against us.

Now this is where we put our stop loss. Initially, this one, we put a stop loss initially, and then you can see during the news, You can see what upper now the newest come over. Many people will freak out and they want to close this trade. In fact as this trade was going on I was creating some short, short videos. So that it’s not going to look like just now that I’m creating this video that I created it. So I’m going to put those video for you to watch then I will come back.

So once you set your stop loss, no matter how, even if the trade is moving towards you, don’t move it. Once you move it, you have broken the rule. Okay Once you move it, remember, that’s one of the reasons why we didn’t put the stop-loss immediately at this line because of this. Okay Every market has a tendency of comment back like this to retest either support or resistance line. And then once it comes like that.

And when we talk about the ISI before your position, remember here, right here. Okay. This place, this was the last place the market got to before we have this downward movement. And of course we are trade in this place and they’re handling this trade right here. You can see how the market has been going up or down, up or down. If you remember one of my videos last week, where I talk about Forex traders and Murphis law.

This is where it comes to play. Okay. This way it comes to play. if I, if I was, if I was off, when I placed this trade, I would have exited my trade here. When I saw this, when I see this one, I would have exited my trade. Okay. Because we could see right there immediately after that it went up, but it’s okay. This is where discipline comes to play. Are you disciplined with your rules Are you following the rule that you have laid down or you’re just gambling.

If you are trading, then you have, okay, this is how much am willing to risk, this is how much am going to get. if this trade goes in my favor, remember you cannot control everything. Only what you can control when it comes to trading is how much you are willing to lose. So this is where we talk about risk management, money management, your emotion. Everything comes to play.

You can see where weight up begin strongly Right now over 80% of forex traders would have gone long. Okay On this pair, this GBP USD, they would have gone long right now. And the big boys know what they are doing. You see what is happening. It could still go up. But where I’m still saying essence is that do not move your stop loss, do not move your stop loss because you put that stop loss there at the first place that, okay, this is how much you are willing to lose.

Okay So by the time you now start moving it around all what you are doing is gambling and that is no longer trading. Don’t be surprised this trade, will calm back down and move in our original direction. But you know, the big boys want to know whether, you know, what are they all not

Okay Remember this trade is on five minutes. If you look at daily chart, if you look at daily charts right now, the daily chart is the trend is up. But when you look over here, you see this candle, you see, this is up, this is retracement, retracing down. So even if we are still on the, the main trend for GBP USD, VTC trend, but placing this trade in five minutes on shorten will actually benefit from the short term downward movement. I mean, that is my one analysis.

That is what I feel. That is what I think I might be wrong. And of course I could be wrong. You know I don’t know these all, but all of them just telling you these discipline is the key. Once you place your trade, do no move things around. Okay Do not move things around and say oh, oh it’s coming and you freak out to close a trade.

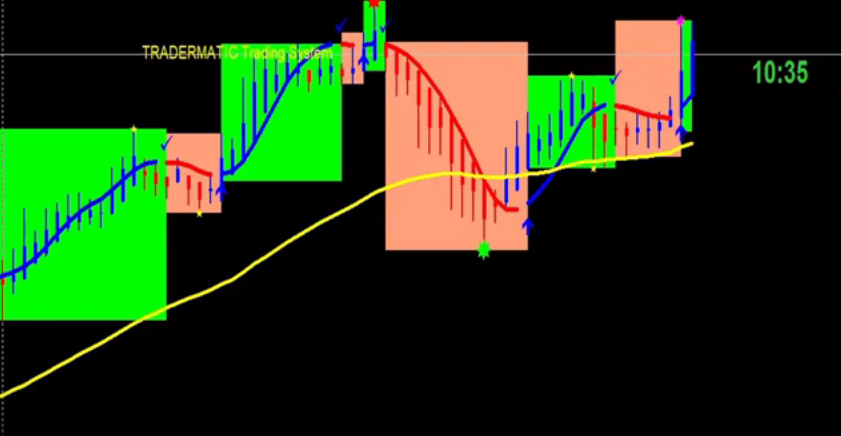

You just discover immediately you close a trade, then the market turn over and start going towards your original direction and you start beating up yourself. Okay So, let’s do that. If you are using tradermatic, tradermatic is showing up actually. Tradermatic is showing up on the GBP USD , as you can see right now, on tradermatic that will go long.

But because that trade that we opened was open during london session that is why am not going to close it. That is why I’m going to live it the way it is. On tradermatic, you can see is actually up. Okay. And let’s see how the market is going to be. And I hope you get one thing or the other from these shots video. Okay. All right. So can you see what I just said.

Okay. Now, if you had freaked out and you close this trade that you had opened by now, you would have been more the losers. That is why over 90% of Forex traders lose money. You know, because they don’t have emotion to carry their trade. I mean, this trade could still go against us, as I’ve said. Yeah. I’m not really saying that.

Okay. Yeah, we, we are one hundred percent right. But what I’m saying, essence, that once you place your trade, once you’ve done your analysis, once you’ve put your stop loss, once you’ve put your take profits, do not move your stop-loss moving your stop plus means that you don’t know what you are doing. Moving your stop loss means that you are telling yourself you are wrong initially. Okay So, but by the time you just leave everything, and worst case scenario, if this market should go against me, okay, what I will do is to go long.

I would still leave this open if it hits my stop loss. So be it, it is part of the game. You know, I’ve said it over and over. You win some, you lose some, but what makes you progress in Forex and in life is that your winning must be greater than you’re losing. So this trade, I wouldn’t be surprised if we eventually end positive but for the sake of the time. And of course there’s a very short video and going to close it, am going to monitor it. And of course, trust me. I will update you how the trade goes tomorrow.

Okay have a blessed day if you have not subscribed to our channel go ahead, hit the button below this video, subscribe. And then like this video, share it on your Facebook page and profile. Then of course leave a comment below. Let me know what you think. Do you think GBP USD is going to go back up or you think it’s going to go back down.

What do you think as a trader? Have you see what what I’m talking about now take a look at this trade right now. Take a look at the trade. I’m not saying that we are on 100 percent right but as you can see on that five minutes chart, okay. On five minutes, you can see that we are on downward movement right now.

This is where we enter our trade. So immediately we enter here, of course will be expecting profit. So the profits, of course, based on this trade right now, this is my first take profit, this is my second take profit, this is my third take profit. I expected to get there. And if he doesn’t I would now monitor my trade. Now what I will do when these first take profit hit, I would move my stop loss, now to break even, but I will not just be caused.

The market was coming at me and I just freak out and close my trade. It’s called maturity in trading, and it’s discipline. Once you’ve set your stop loss, once you put your take profits, you even walk away from the system. Now let’s go to tradermatic and see what is this GBP USD. As you can see these GBP USD, this is downward movement.

Also, as you can now see on GBP USD right now, you can see, okay, my Heikin-Ashi candle is down my, trend is down, I have a bearish box. My marcd pro is down of course stockhatis is down. So what are we saying Or the short time, five minutes of course we are on down movement. So now imagine if you had freakout when the market got to this place, you will have lost that trade and you would have beating yourself – oh my God.

Okay. so that is why you need to do your analysis very well. Make sure that you know what you are doing and don’t just freak out. Don’t let your emotional control. Yes it happens most times but of course you wan to make sure that you don’t over position your account, you don’t over leverage. We have peace of mind to be able to, you know, accommodate whatever the market throws your way.

Okay. This saturday I’m going to be exposing my three step strategy that I use to siphon cash – non stop from forex market every day. I called it three steps to four figures daily income from forex. So make sure that you click the button below. If you do, if you have not registered, it’s free training, but you still have to wait to start to be part of it.

And therefore everyone that attended training monster yesterday, you’re going to be getting the digital version of my latest book – four figures daily forex system for free. A proven system for making daily 4 figures from market, even with zero trading experience. Okay So you doing want to miss the training. The training is going to be on Saturday this Saturday, by 9.am central time, that’s going to be 10am eastern time and 3pm Nigerian time. Okay I look forward to seeing you there. Keep harvesting those pips, you know, get the discipline. Discipline that is the key when it comes to trading. You know, you need to be disciplined in life. You need to be disciplined in your Forex. You need to be disciplined and in your marriage you need to be discipline. You need to be disciplined. So removed discipline from your way, all you have is failure,loss, and I hope you are gone towards getting discipline even as you learn this forex art and science. I’ll see you tomorrow.