I’m going to be showing you how to turn every losing trades to winning trade – the forex hedging strategies. Okay. Everything losing trade, how to turn them to a winning trade in other words ‘how to hedge your Forex trades for profits. That is what we’re going to be looking at in this video.

Okay So let’s say you enter a trade, and all of a sudden, the market turns against you – how do you takes care of it. How do you turn it to a winning trade.Or let’s say that you enter a trade and that trades is going in your direction all of this sudden the markets turn against you and you don’t want to possibly cut off your loss. You know there are different trading strategies. Some strategies are used as stop loss. If you use stop loss, then it therefore means that you’ve already decided before you enter a trade you gives out to move forward. I did decide that before the trade, and that is the normal things to do anyway.

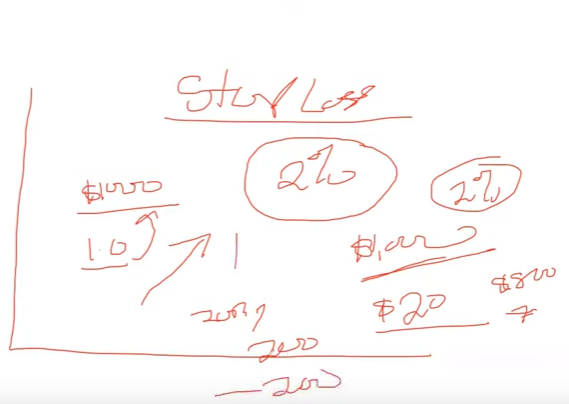

For instance you might trade some indices, I don’t use, I don’t use a stop loss because it’s a very volatile market. But in books and in theory that is what you are expected do, okay. Before you enter any trade, you should be able to determine how much you are willing to risk. And that is your stop loss. Okay so that is your stop loss. We have discussed this extensively in the past. Every single trade you don’t want to risk want to risk more than 2% of your, of your account.

I’m a kind of person that I don’t use stop loss in most of my trading. don’t use stock, mostly most of my tradings. and this small —— are teaching me a are teaching me a lot of things. okay. So let’s say for instance, your account balance is $1,000. Of course you don’t want to be risking more than $20 of this account. That is 2% if I’m correct. So that is 2%. And one of the reasons why many people lose their account or burn out there account is if this $1,000 account, you will see people risking almost $800. Some will risk about even like 750. Imagine somebody that have an account of $1,000 and he is trading euro/usd.and put in 1 lot size, 1.0 lot size.

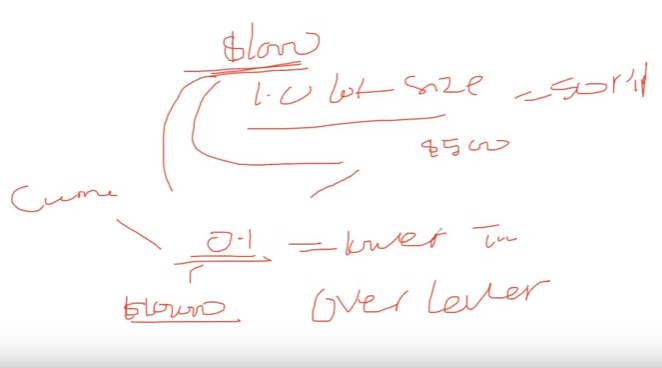

If you are lucky, and this trade goes in your favor, it will look as if you win jackpot because before you know it, you just say wow, maybe just 20 pips, 20 pips and you have made $200. But what happens if this 20 pips is against you, it’s missed that is minus $200 automatically, or what if you are trading You have an account of $1,000. And you are risking – you place a trade of 1.0 lots size which is wrong. Okay I don’t care. What kind of timeframe you are using either it is lower timeframe or higher timeframe. This 1.0 lot size, that is alot for $1,000.

But that is awesome.what some people do so when they place that if this trade goes in your favor boom you make maybe $ 500. You harvest 50 pips, immediately you’ll be so excited that – wow this is cool. But what happened if this trade also go against you that would be one thousand dollars minus five hundred dollars if $1,000 account what you want to be trading is like 0.1 that is even if you are trading on lower time frame.

On lower time frame 0.1 that is if you are trading regular currency pairs if you are trading on higher time frame then this 0.1 will even be for an account of like $10,000 so with this you know that your mind is at risk if you place a trade and you can’t go to sleep if you place a trade and you can’t leave your desk if you place a trade and you can’t close your eyes if you place a trade and your blood pressure is rising it therefore means that you have over leverage that account .

Okay that is just by the way so what we are discussing today is how to turn every losing every losing trade to a winning one that is how to hedge your trade – how to edge your trade how to hedge your trade so a discipline means that you are opening a reverse position to the initial position that you already have opened so you you go you go long.

Immediately the market starts going against you then what you do if you did not use stop loss is you can open a reverse – a reversal position to that trade okay does that does that make sense to you guys now so that is how what we call energy some brokers allows it some broker does they don’t allow it but when you are fortunate to be using brokers that allow it then you are lucky and we are going to be looking into taking some examples and of course we we tied it up so let me share my screen with us once again.

Forex Hedging Strategies – Definition.

This is this definition of hedging, hedging in the forex market is the process of protecting a position in the current pair from the current risk of losses that word is very very important this word very very important that is the currency pairs that you are trading so if you have a trade on euro/usd if you have a trade on euro/usd which is long position.

Okay if you want to edge this market the same currency pair that you have going on is what you are focusing on not that may be okay you have long positions 0.1 on a euro/usd then you now see another opportunity on gbp/usd and you open that trade that is no longer hedging that is no longer edging when you are hedging you focus on the emission you focus on the initial pier that you are dealing with is this making sense.

If this is making sense to you type yes on the chat window so you are dealing with that same currency pair that same currency pair that you are trying to deal with is what you are going to open in a reverse direction now there are two ways of edging okay two ways that i normally do.

The first one is if you are entering the tree and you are not clear you are not clear with. Okay the direction to go so ordinarily if i’m to trade a zero point. Let’s say if i’m to trading 0.5 lot size. Okay if i’m to trade 0.5 lot size so, initially i could just enter 0.1 for that trade so if this 0.1 is going on against me then i can now open 0.4 lot size okay in reverse direction i cannot open 0.4 in a reverse direction that is the first way the first way you can hedge.

You can turn a losing trade to a winning now the second strategy is if there’s a market as deranging and you don’t know the direction it will go. okay a market has been ranging and you don’t know the direction this market will go so this is the high this is the low i use this with fx sniper if you have fx sniper especially on one hour time frame especially on one hour time frame i use fx sniper with this strategy so what you can do is that you open two pending orders so you open buy – buy stop.

Here you open buy stop your stop loss will come below here then this place that it is your stop loss that is where you open as a sell stop \then this buy stop here will be your stop-loss for the side position so you have two threads open okay you have two trays open so when i don’t normally recommend it but this is what some people do i’ve done it one or two times and it worked best also for me so when the market triggers the first trade that triggers then you close the second one.

So let’s say the market now break out upward so you have your buy stock triggers then you quickly will close the the down the the short position so let’s say the market triggers and your set stop triggers then you close your buy stop so that is another way of hedging the market because number one you don’t , you you are not sure of which direction the market is going to go or immediately there’s a breakout then it can give you that uh insight of what to do but of course you know that there are some volatile markets that we trigger yourself stop come back to the buy stop and then cut off both of them and start going in another direction market happens or it doesn’t happen like that all these.

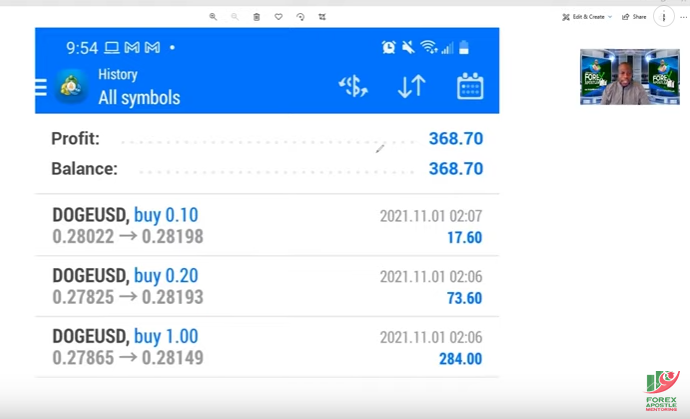

So i’m going to take us to let’s let’s go to the chart and see i hope we’ll be able to pick some one or two trades and demonstrate what we just what we just discussed if you have any question you can go ahead and ask a question based on the strategy we are looking at so this is a Doge this Doge/usd i picked dodge because it’s a weekend and i believe it’s moving it’s trading let me see if a bitcoin also is moving this is a ghost way so august way i see btc is not ticking but DOGE coin is thick so now what i was explaining before is let’s say in this place you open a trade let me so normally this is you open this trade let’s say you want to be going short or ordinarily you are supposed to have let’s say 0.5 as opposed to put 0.5 lot size on this tray then i can decide to put 0.1 so like this one now this is going up so i can do 0.1 and i’m going to just go ahead and do that you can see 0.1 i’ll go click on buy so i buy now 0.1 that is expecting it to go up now if you look at this this is imagine that i’m using this in ninety thousand dollars account and this is a live account actually so this is what i’m talking about if you have a trade like this:

Number one ordinarily you can do this trade out and just go to sleep okay because no matter how this trade you know that there’s no way you can run down your account i always focus on this my imagine the ordinary levels of the times like for this margin level to be above one thousand percent but there are situations that can rise to like maybe 500 or 600 there about i even have had trade that will be like at 300 percent and that is on the extreme risky level actually but on a normal normal uh level i always want this my margin level to be like one thousand percent so you can imagine okay i put 0.1 for a DOGE, DOGE-USD this is one minute in order for us to be able to practicalize what we are talking about so now i put in that 0.13 and what i’m what i’m expecting is for the market or to go up so let’s say this market now continue going downward then what i will do instead of instead of opening 0.1.

Because if you open 0.1 it will nullify this uh this initial 0.1 that you have so if i have 0.1 short long position and the market keeps going down okay and i want to edge it what i will do is i will open like 0.2 shots so by the time this 0.1 let’s say it’s like a 0.1 position it’s like a minus 10 dollars you will discover that the one that you open as 0.2 might come up to be like a plus twenty dollars so if you close the two trades at this time then you can still go home even with what ten dollars so that is how how i normally treat that and that would be so like for instance now you see this market supposed to be going up now all of a sudden we see it the way it stays coming down.

I will not place this short position because number one this is a one minute this is one minute and then you can see this bollinger band we are in the lower bollinger band here we are this is all power so every time the market is set is below this lower back okay you can do your testing having a back test anytime the market comes below this lower bank of course it will always find this way at that back to come and touch this lower bollinger band continue again or even most times just come back and go back up it might come to the middle bar and start coming down or break out from this middle bar and go to the upper this is the customizable by the way this is a customized one and the the regular polygon band user 20 but this one uses a two on break if you go to input so the bands period you can see i change this to $200 original default value is $20.

If I change it to 20 now this is what you will see okay this is what you will see this is the default value but i don’t like using using this so i like to use this to be 20 and what i normally just use it for is to target my entry break out like for instance if it comes like i know it will definitely go back up as you can see so because the good is for it to come back up uh if you see what happened to zero zero usd yes the euro usd let me change to let me change to this so like euro/usd if you go if you go back to let’s say like 15 minutes this strategy works both in the four hours, a daily or whatever so because like yesterday when some people saw okay yeah euro/usd is going down it’s going down it is when it gets to this place.

They start going short and you can see what the market does coming back right inside there so you have to understand anytime the market breaks out okay anytime it breaks out i know this is uh this is different store the topic we are talking about but it’s it’s by the side anytime it breaks out like this that’s what i use this for i know one way or the other to find its way back it doesn’t matter whether it’s four hours it doesn’t matter whether it’s uh daily it will always come back like that okay so like right now you can see we have 14 we have 14 dollars this is this is real money this is life accounts because i know it’s going to come back to that point but let’s assume that it keeps going down okay.

That is what we’re talking about an hedging then I will now open a reverse position and put it like maybe 0.3 or 0.4 in order for me to negate the zero that is there so as you can see right here you know what actually happened as this is the first trade that i placed in that example uh on saturday morning when we were having the class and then when i noticed that okay the market was moving in my favor as you can see the date that was um you know uh i just okay you know what i think i can to help so i had it you know 0.2 if i got a time i had a 1.0 lot size so that’s a DOGE coin USD trade and of course I ended up making 368 dollars from that trade so that is another part of a hedging you know you could add to your position because as the you know if the market moves in your direction yes of course there’s no crime as long as you maintain your risk our money management but understand the concept of hedging.

okay the market is going against you instead of you closing that losing trade then you can open a reverse a reverse uh trade a reverse order you know in order to overwrite whatever draw-down or negative that you have in that particular uh negative trick so i hope that this makes sense to you if you have any questions there’s going to be a comment section below this video do me a favor leave your comment like this video subscribe to this youtube channel by you subscribing to help us with youtube and guardian okay this is a free video well not created out of my business schedule for you okay

thank you so much my friend and of course i look forward to see you in our next video and in case you are watching this and you are wondering okay how can you guess that the trading forex or maybe you have been trading forex with no reasonable or legitimate or you know any pronounced result and you need a better well i volunteer myself i can coach you i can mentor you all you have to do is up visit http://www.theforexapostlementoring.com/

You know put in your email address get detailed information about what we offer and right now we are running a promo and i hope you will just opt in and that one let’s make this crazy money together i look forward to helping you with forex.