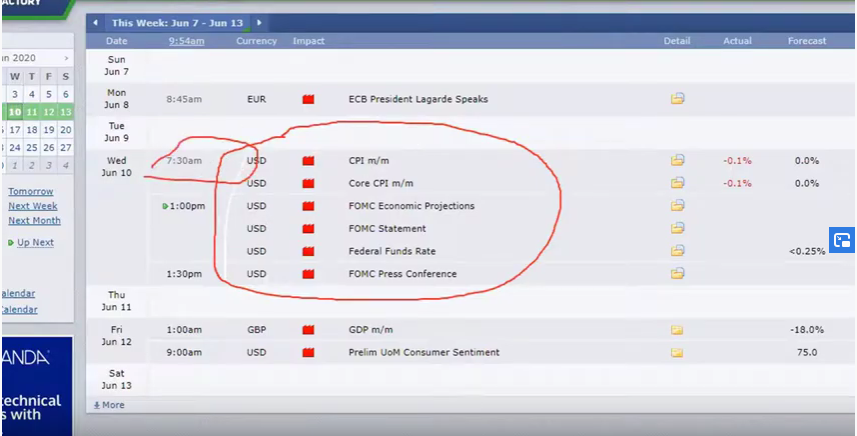

I want to welcome you to today’s video. It’s been an awesome, awesome. Where’s the money? ofcourse with all the news coming out, and we are still expecting one by 1:00 PM. You know, let me see. I was going to overhear. Okay. As you can see, it’s been a very, very, you know busy day for USD pairs change.

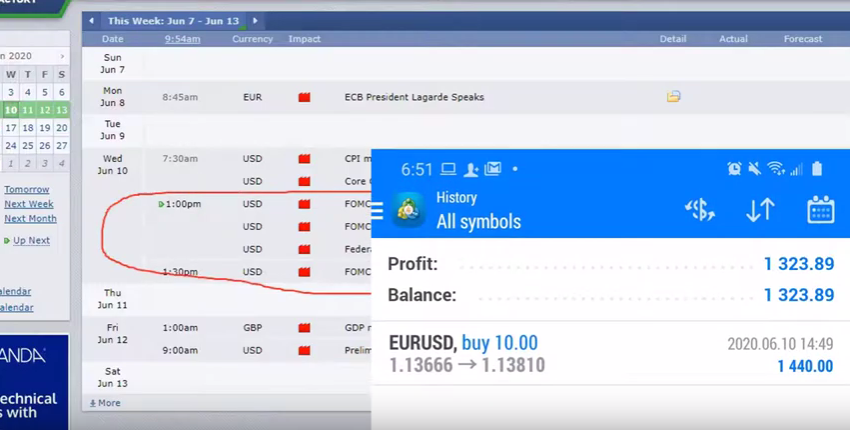

It’s been a very, very busy day. So the 7.30am , I mean, it has been a whipsaw did like open down, up and down, especially for most currencies Euro-USD. but we still make pretty much, this morning. let me check my phone. Yeah, $1323,. Not bad, but for this morning trade, are we expecting anyway, we’re still expecting the, the 1:00 PM central time, the FOMC economy projection. And of course the statements. So these 1:00 PM central time, this will be 2:00 PM it’s that time and if you are in nigeria, this will be your 7:00 PM.

So by that time, if you are watching this video right now and you are at work, you must have got back and try to , you know if you love trading the news. This will be a very good trade. Okay. anyway just to throw that out there. My name Emmanuel Adegbola. I want to welcome you to today’s video, today we will going to be looking into Forex trading cheat sheet with tradermatic. okay. many people have been asking me, so what are the things we need to look into while using tradermatic, how do you know it is time for you to buy and how do you know, it is time for you to sell. All of these would go and look into in this video.

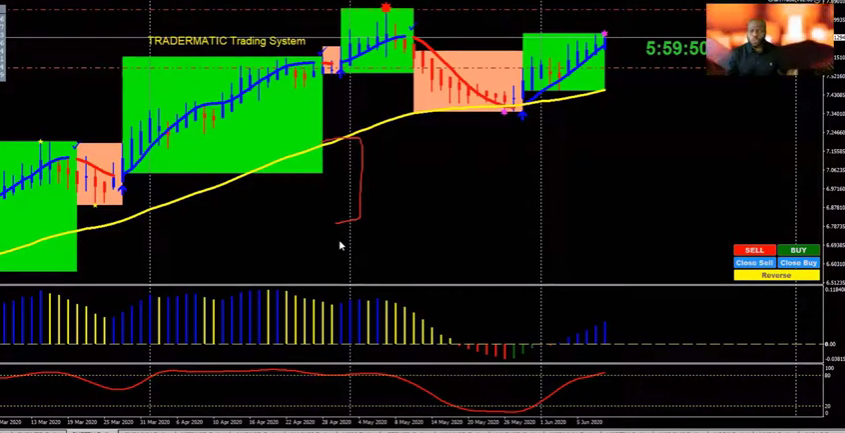

So how do you know when to buy or when to sell, especially when you are using tradermatic system, you know, by now, you know, that’s am a technical indicator trader and ofcourse I develop my own system which my students and some happy buyers are using now, because I hate all the structure that had to do with regular that has to do with regular candle-stick, double bottom, double edge, head and shoulder all those drives me crazy. I’m a visual person and I love colours.

I like to see, you know, Colours and it makes it easy for me. Even my six year old kids, you know, easily just grab this. Okay Okay. Once you see the blue arrow, and this blue out of closes go long. Once you see red and the red arrow closes go shot it’s as simple as that. So now how do you know when to buy and when to sell So if you are, you want to buy no buy one, your price must be are above this filter line. We call this one, the filter line. Okay. It’s 50EMA. Yeah. Okay. So the price must be above these, that’s number one. This Heikin-ashi candle must be bullish. Okay. This is how you know when to go long. Okay.

So the prices above the box also is bullish. Okay. You see the boxes bullish, trend line is bullish. Okay. So the trendline is bullish, macd pro right here as you can see is bullish and stochastic is bullish. That is trending up above 20 ofcourse, less down 80 line. So by having that one, you know, the situation and the condition is okay for you to go long, you have the market, you have the setup. For example, in this situation here, MACD is going up as you can see, MACD PRO, stochastic is going up as you can see is above 20. The price is above a 50 ema. The candle here is bullish. This is swing trading and ofcourse, this trade now has been on for like 9 days as can see the profits so far, right here is a $1,000 so far.

So the trend, the trend is still going. This was where we have our stop loss initially. Then later we move it to breakeven we move it over here right now. This is where our stop loss this. So even if this trade is going to go against me. Of course, I have nothing to lose. And this is where we are still going. Okay Because all you have to do is look into your left and if you are going bullish, the very first bullish box. You see use that as take profit. If you are going shot, for example, go shot here. The very first bearish we see would be my take profit is as simple as that. So that is the condition for going long. So let’s look into condition for going shot. Do you know when to go short, with tradermatic Number one, the price must be low.

Okay. The price must be below our filter line. This is a filter line. Let’s change this, to this. So the price must be below. The price must be below that’s number one, number two, the box must be what bearish, our Heikin-Ashi candle must be what? Must be what must be bearish. And of course, the MACD pro must be below the zero line or bearish also as you can see it’s going down, and ofcourse stochastic must be above. Okay. This trend. Actually started from here. So must be below 80 and of course, above 20. So you can see stochastic also is bearish. Okay. You see right there. So stochastic must be bearish, macd pro must be bearish, as you can see, the, of course the trendline be bearish, as you can see, then the price must be below this, once you have that and you have the setup then, you know, it is time for you to go short, it’s as simple as that and to make it actually easy for you, the arrow tells you what to do, you see there’s you want to do you see the arrow was the arrow closes

it is time to go along. And if it’s time for you to go short, once the arrow closes like this, it is time for you to go short. It’s as simple as, okay. Okay. My friends saw once again, I want to thank you for watching this video is a very short video, and I hope you just get the nugget as far as if you are one of tradermatic user. And if you are looking also to get get tradermatic, click here , check it out on the . I will look forward to get your testimonials also have a blessed.