If you are reading this content right now then chances are that you have lost some hard earned cash to Forex Sharks, Bulls and Bears or you are just curious to know how it would feel like when someone loose money in Forex.

Yes! Let’s face it. All Forex traders lose money at one point or the other. Even in life we lose talk less about business and especially the Forex trading.

Forex trading is a high-risk high-gain business. We take risks in Forex trading but we take what’s called “calculated risk”.

“Risk comes from not knowing what you’re doing”. . . Warren Buffett.

That’s very correct. I do say it that “in life, you win some and you lose some but as long as your outcome is income then you are in business.”

So, how do you deal with loss in Forex trading?

Please take note of the word “when” and not “if”. How do you deal with loss when it happens because it’s going to happen at one time or the other during your trading careers. I hear from many Prospects that “oh, i can’t trade Forex again because I’ve lost so much money to the market”.

Let me ask you this question; If you were involved in a car wreck, would you because of that don’t drive a car again? No! I see some Forex traders or “Forex Traders WannaBes” when they lose money or burnt-out their accounts then they develop what’s called trading apathy”, they quit and only to find themselves coming back to Forex may be a few months after.

First of all, I think before you quit Forex trading, you need to ask yourself some questions. Questions like;

- Did I follow my trading rules?

- Did I apply my money and risk management?

- Was I patient enough?

These and many questions need to be asked and answered. Try and learn from this feedback. If you are losing the first thing is to stop that live account and go back to Demo trading to perfect your strategy again. Do not do revenge trading. You can’t win the market.

Just like any other types of loss, when you lose money in Forex you go through some stages of grief. Depends on whom you surround yourself with, some would get over it faster than another.

The Stages of Grief

Let’s now talk about grief and loss because it is part of Forex trading.

One of the things I talk about is splitting up the risk and following the rules. I find out whenever any of my students lost their accounts. They did not follow the rules or went all in and did not manage risk. I usually teach not to risk more than 2 percent of your account (even though many times it looks like a trading theory but it makes sense. There are times that you would have a losing streak, so let’s say you risked 2% of your account and you lose 5 trades consecutively (which could happen sometimes), all you would have lost would be just 10 percent of your account. But many would risk more than 50% of their accounts or even 90%… In this situation, all you need to burn-out that account is just 1 trade. Take it from someone that has lost big time to Forex.

Risk and Money management is an important lesson to go over before you place any trade: Follow the rules! If you are about to enter a trade ask yourself “Am I following the rules?” “Am I FOMO right now?”

OK let’s talk about The 5 stages of grief ( responses to loss).

These stages are

- denial,

- anger,

- bargaining,

- depression,

- and acceptance.

Someone who is grieving may go through these stages in any order, and they may return to previous stages.

Denial: “This can’t be happening.”

Individuals may refuse to accept the fact that a loss has occurred. They may minimize or outright deny the situation. It is suggested that loved ones and professionals be forward and honest about losses to not prolong the denial stage.

Anger: “Why is this happening to me?”

When an individual realizes that a loss has occurred, they may become angry at themselves or others. They may argue that the situation is unfair and try to place blame. In fact, some would blame their coach if they have one or blame the system they used.

Bargaining: “I will do anything to change this.”

In bargaining, the individual may try to change or delay their loss. For example, they may try to convince themselves of unlikely cures in the case of serious loss. Once an account is burnt-out, face it and agree that it’s burnt out, it’s gone. People have even tried to sue their Forex broker that transacts over 8 billion each day. These people are not accepting the loss and get stuck in this stage – not being able to move forward and learn from the mistake could complicate the whole issue. Also not realizing the rules have been broken. Following the rules would have been a 2% or 10% loss. Not a loss of everything.

Depression: “What’s the point of going on after this loss?”

At the stage of depression, the individual has come to recognize that a loss has occurred. The individual may isolate themselves and spend time crying and grieving. Depression is a precursor to acceptance because the individual has come to recognize their loss.

Acceptance: “It’s going to be okay.”

Finally, the individual will come to accept their loss. They understand the situation logically, and they have come to terms emotionally with the situation.

Acceptance is the best stage because it allows you to re-group. Review the steps. Look at the rules and follow them. If you backtrack and are able to analyse the loss, you would probably find that the rules were not followed. Could have done A,B,C better and realised that some of the trading was done emotionally or too much risk applied. Or not split out the risk also is a common issue.

Take care of yourself first! You are number 1 and only you can accept and move on.

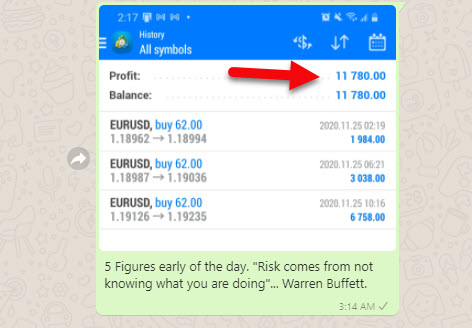

As at the time of typing this content (it’s 3AM central time) , I’ve made over $11,000 and the day has not even started.

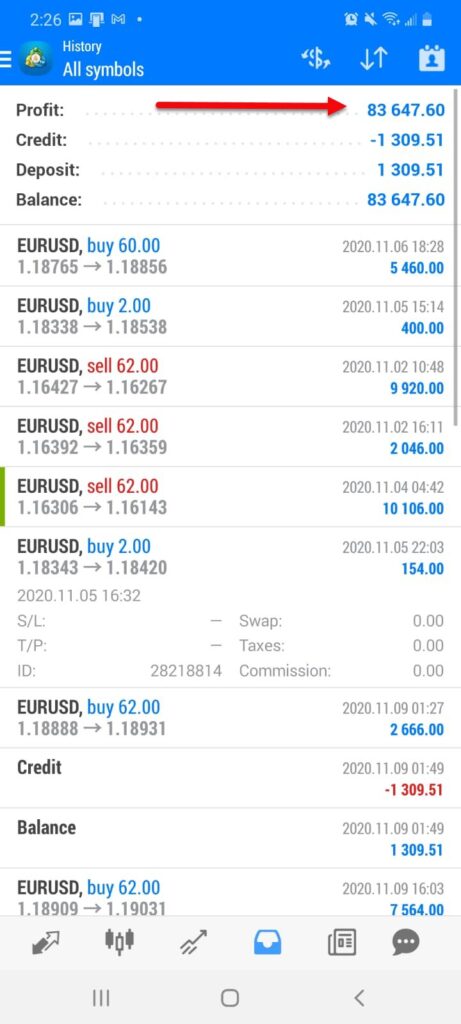

As shown in the image above, that’s over $80,000 from one account so far this month. Pure profit. Last month from 2 accounts we did over 90K, you can see the proof here.

Why Am I Showing You All of These?

I showed you the above images not to impress you but to impress upon you that you would be learning from the “doer” and not the “talker” when it comes to Forex trading.

I didn’t start up also this way. In fact, I burnt-out my first 6 live accounts when I was getting started in Forex trading back then in 2006 before I got help. Don’t wait till you burn even your first live account before you get the kind of help that you need for your Forex business.

Depends on when you are reading this content , you could join The Forex Apostle Mentoring Program for 80% Discount. Please note that this is strictly a Thanksgiving Offer, after the 30th of November, 2020 this offer is gone forever. Click here now to learn more about how to join.